stock option tax calculator canada

By including this 10000 on your tax return you could deduct 5000. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Taxation as an investor Bob makes 110000 per year in BC.

. Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic. The employees benefit inclusion is 20 10 10.

You can calculate your Annual take home pay based of your Annual. After 10 years at 7 options are worth 24179. It was a background issue.

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. Box 14 may include other income 100000 100000. The calculator will show your tax savings based on the specified RRSP contribution amount.

Thus making a stock option very tax-efficient. Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. All federal and provincial taxes and surtaxes are taken into account however the calculator assumes that only the basic personal tax credit as well as the dividend tax credit and Canada employment amount if applicable are available.

Even after a few years of moderate growth stock options can produce a handsome return. That means youve made 10 per share. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

How much are your stock options worth. Use this calculator to determine the value of your stock options for the next one to twenty-five years. If you have any questions on how to calculate the alternative minimum tax or any of.

The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. Under the employee stock option rules in the Income Tax Act employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid. So if you have 100 shares youll spend 2000 but receive a value of 3000.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. Calculate the Annual tax due on your Capital Gains in 202223 for Federal Provincial Capital Gains tax. You can calculate tax on stock gains in Canada by figuring out what type of investor you are what type of investment income youll be making and what your tax bracket is.

Because only 5000 shares were exercised they all qualify for the deduction. The taxable benefit is the difference between the fair market value FMV of the shares or units when the employee acquired them and the amount paid or to be paid for them including. Amount to be included on the T4.

Exercising your non-qualified stock options triggers a tax. Security options deductions. During the vesting period you can pay ordinary income tax on the restricted stock award or buy your shares and pay long-term capital gains taxes.

Just follow the 5 easy steps below. Select Province and enter your Capital Gains. Deduct CPP contributions and income tax.

409A Value of Shares at Exercise. One-half of the amount taxable 1101d 100000 x 50 50000. How Are Stock Options Taxed In Canada.

This permalink creates a unique url for this online calculator with your saved information. You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Considering certain conditions are met you can claim a deduction equal to 50 of the stock benefit. Report a problem or mistake on this page. Taxes for Non-Qualified Stock Options.

For example the option price is 10 for 15 shares and the employee exercised the option when 15 shares were worth 20. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the commission fees for buying and selling stocks Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. Type of Option ISONSO Strike Price.

If shares are valued at 20 at that time the stock is worth 20000. This calculator illustrates the tax benefits of exercising your stock options before IPO. The Stock Calculator is very simple to use.

For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1. Please enter your option information below to see your potential savings. Cost of Capital of shares Value per Share at Exit.

You will only need to pay the greater of either your Federal Income Tax or your AMT Tax Owed so try to be as detailed and accurate as possible. Employees who exercise employee stock options are required. When determining the amount of the security option benefit subject to income tax withholding we will permit the employer to reduce the benefit by 50 using the Security options deduction under paragraph 110 1 d.

Annual Capital Gains Tax Calculator 202223.

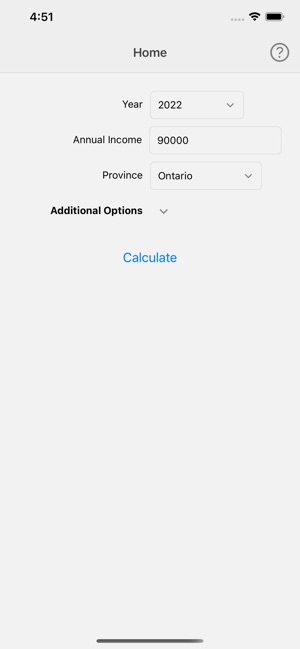

Canada Income Tax Calculator On The App Store

Restricted Stock Units Jane Financial

Canada Income Tax Calculator On The App Store

Income Tax Calculating Formula In Excel Javatpoint

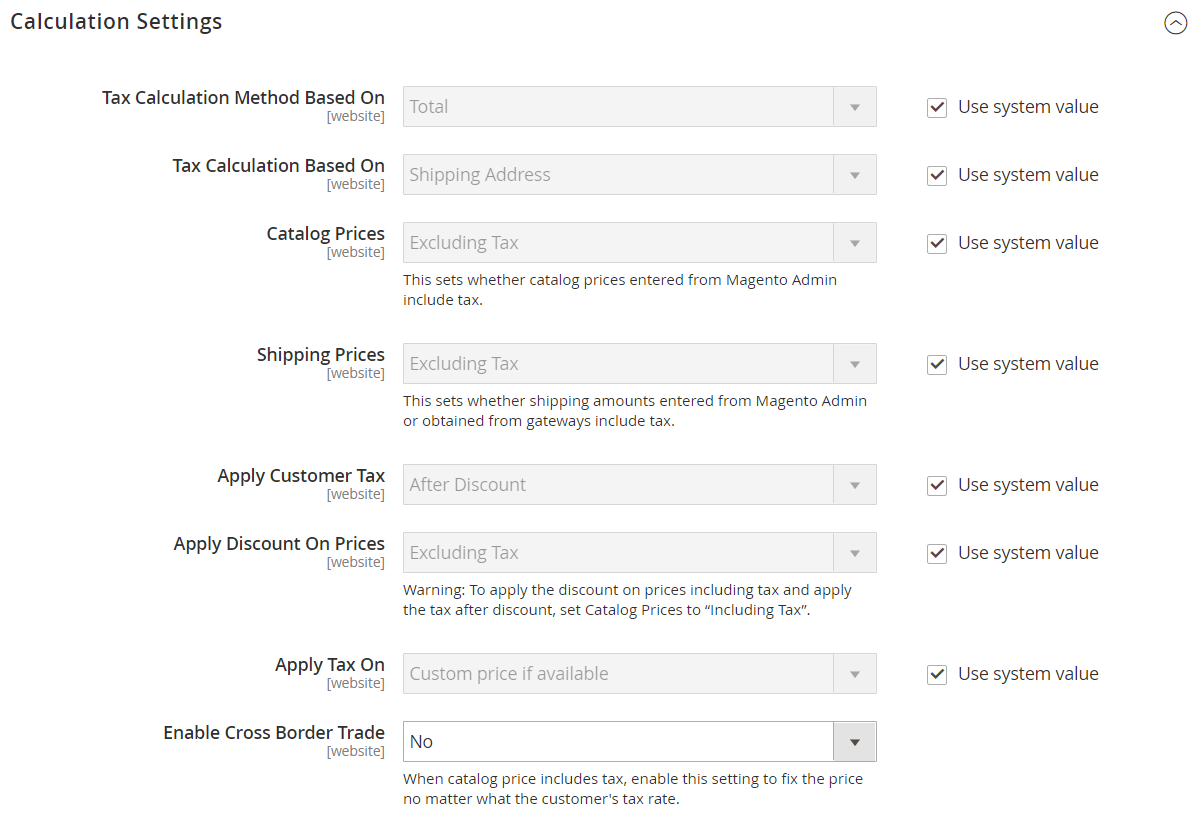

General Tax Settings Adobe Commerce 2 4 User Guide

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

How Stock Options Are Taxed Carta

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Canada Income Tax Calculator On The App Store

Capital Gains Tax Cgt Calculator For Australian Investors

Land Transfer Tax Calculator A Strong Option To Get Home With Land Transfer Tax Basic Facts Life Facts Home Equity Loan

How Stock Options Are Taxed Carta